Renko Charts

Renko Charts are a Japanese Charting System similar to Point and Figure Charts but instead of X’s and 0’s as are used in western Point and Figure Charts, Renko Charts use blocks. Renko is the Japanese term for brick. Most Renko Charts have a predetermined “brick” size or number of points that each brick represents. A new brick is not added until the total number of points is reached. However, the price action can exceed the brick specification of points, especially in western markets were pennies are often traded.

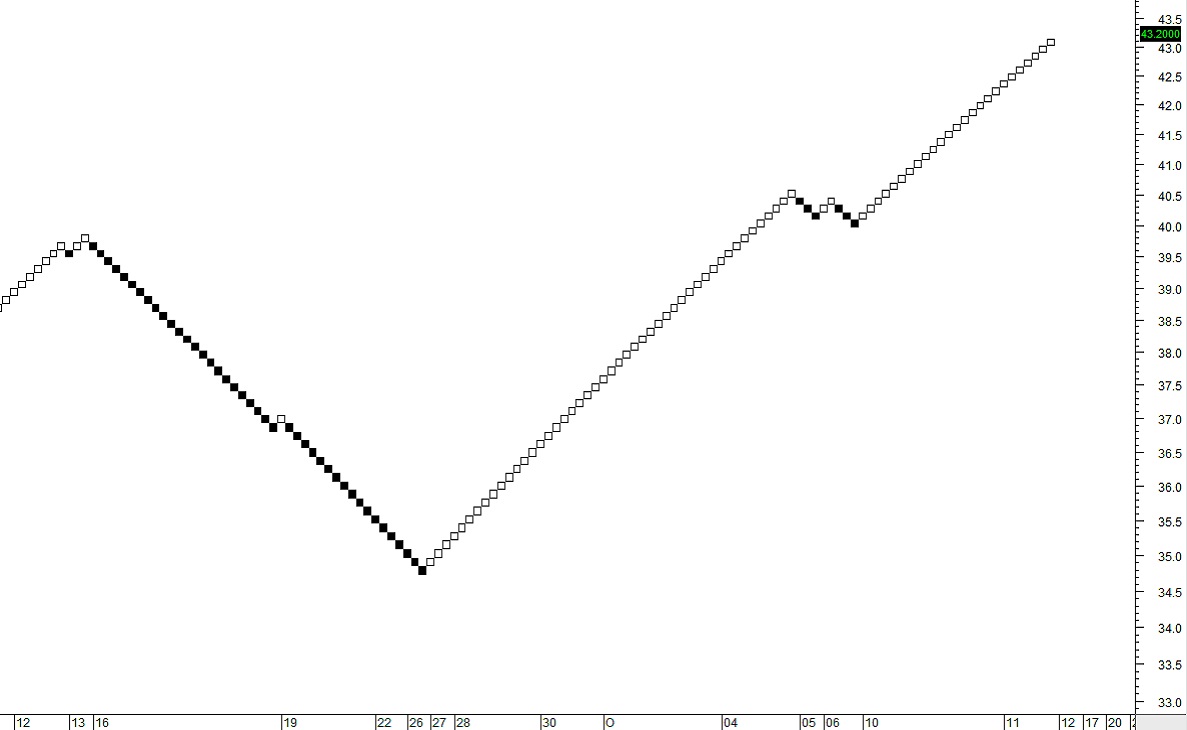

Renko doesn’t provide any details about the open, low, high, or close. A brick may represent one day or many days depending on how much price moves. Renko can use either Absolute Points or Average True Range in the brick size calculation. White bricks are upside action, black bricks are downside action. The goal is to identify typical reversal patterns such as inverted V tops, W bottoms etc. It also is used for long term support and resistance levels by drawing a trendline to define resistance and support from various up and down patterns.

Renko charts are simple charts that are easy to read, however they lack critical data that most retail traders need to make prudent short term trading decisions. Since the bricks can form over extended periods of time, this charting is not ideal for short term trading but lends better to longer term analysis. Renko has no volume within the chart and volume bars and other volume indicators must be used in conjunction with the Renko bricks for complete analysis.

Renko has limitations and is not recommended for any short term trading styles used by retail traders. It may be beneficial for long term investors, mutual fund investors, and others who need to see resistance and support patterns in a simple clean graph.